Assessing IBC Technology's Market Potential: Insights from IBC4EU by Becquerel Institute

IBC4EU Partner Insights

Deliverable D7.5 "Market status report including benchmark with competing technologies", available in the Project Reports section, identifies the most suitable PV applications for IBC cells and modules, assesses their market potential, compares IBC with competing PV technologies, and explores future market development possibilities

The PV landscape has transformed from small multi-Si to large mono-Si cells, shifting from p-type to n-type, driven by wafer cost reductions and higher efficiency demands

Historically, IBC technologies represented a small portion of the PV market. However, recent developments in terms of cost have led to a significant increase in annual installations. Estimates show that almost 7 GW have been installed in 2022, and forecasts suggest that under a business-as-usual scenario the annual market share of IBC technologies will reach 12% by the end of the decade, with annual installations projected to reach around 134 GW by 2030. These forecasts emphasize the expected growth and maturation of IBC technologies, aided by projects like IBC4EU

IBC technology's potential varies across PV segments, with immediate opportunities in distributed and integrated PV, while in the long term all applications are within reach, as cost decrease and efficiencies improve

When compared with other technologies available on the market, IBC technologies offer specific features such as its unique rear-side design and increased energy conversion efficiency. Despite past challenges, recent developments, including polyZEBRA and POLO IBC cells, have improved cost effectiveness, compatibility with mainstream manufacturing equipment, and efficiency.

These characteristics suggest that the end-use applications for which IBC technology should be the most attractive are the distributed market, especially residential, as well as some integrated PV applications. Their significant market potential in absolute terms, combined with a higher willingness to pay of the end-users, makes these PV segments preferential targets that fit well with the attributes such as efficiency and aesthetics of IBC technology.

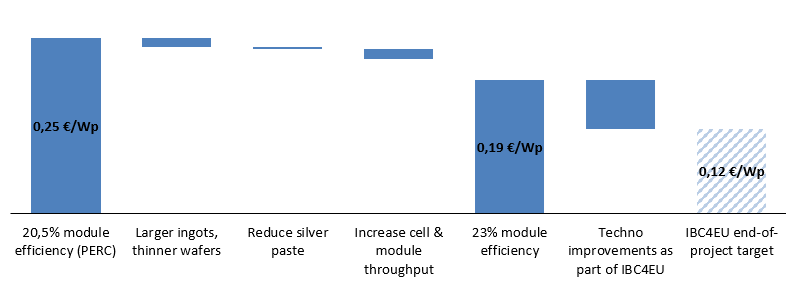

IBC technologies are currently pricierthan competing ones, but nearly match them in LCOE. Innovations from IBC4EU aim to lower manufacturing costs to €0.12/Wp, boosting competitiveness across all segments

Although the manufacturing cost of IBC technology remains higher than those of PERC and TOPCon, or even HJT, recent advancements and economies of scale are closing this gap. With ongoing innovations, such as those from the IBC4EU project, the manufacturing cost of IBC modules could decrease to decrease to around 0,12 €/Wp, significantly enhancing their competitiveness across all market segments. As a result, IBC technology is already cost-competitive for distributed residential and commercial segments, and it is anticipated to further improve in the coming years.

Figure 1: Technology roadmap with projected minimum sustainable prices for mono-Si modules, assuming 15% gross margin

(adapted by the Becquerel Institute from NREL)

The potential of IBC technology is huge and will shape the future of the PV sector with enhanced efficiency and affordability, with up to 60% market share by 2030, equivalent to 668 GW per year

Thanks to these possible major technological developments, the IBC technology could achieve levels of performance in terms of efficiency and manufacturing cost that could enable it to penetrate the market more significantly. Depending on the performance achieved by IBC, this technology could capture from 12% of the annual market by 2030, in the business-as-usual scenario, up to 60% in the best case. This would represent an annual global IBC market of at least 134 GW in 2030, up to potentially 668 GW in the best case scenario

Figure 2: Forecast global IBC annual installed capacity share & market for three different IBC development scenarios

(Becquerel Institute analysis based on ITRPV 2023)